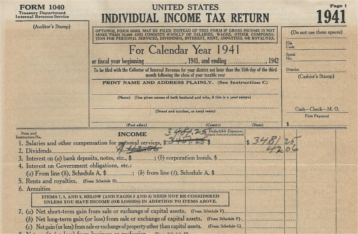

Treasury Secretary Steven Mnuchin said that the new promised postcard return will be released this week. The New York Times has reportedly obtained a draft of the new Form 1040 and posted it in their news article on Monday. The current two-page form is condensed into one page by introducing various new schedules that need to be filed for the reporting of details that would otherwise be included on the return today.

When the rubber meets the road, if what the New York Times reported proves to be correct, taxpayer, who are used to the 1040 in its current format which traces back to the 1970s, may not find the new form any simpler to prepare. In addition to understanding the impact of the recently enacted Tax Cuts and Jobs Act (TCJA), they will now need to spend time navigating a different layout and prepare new schedules that may need to be filed as part of their returns.

With another six months before the end of tax year 2018 and two more quarterly estimated tax payments coming due, domestic and expatriate taxpayers alike would be well-advised to review their taxes in relation to the TCJA so that they may plan accordingly and make the relevant adjustments. They should also stay attuned to further developments as regulations for the TCJA have yet to be promulgated.

American Expatriate Tax is a part of Contexo Global Mobility Solutions & Tax Consulting Ltd. registered in Hong Kong. Together, we help companies and individuals navigate through the complexities of global mobility and related tax issues. Here is where you will find a blend of expertise from Big 4 accounting firms and Fortune Global 500 companies but the attention of a boutique consulting practice. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.